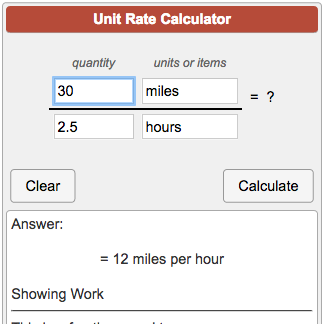

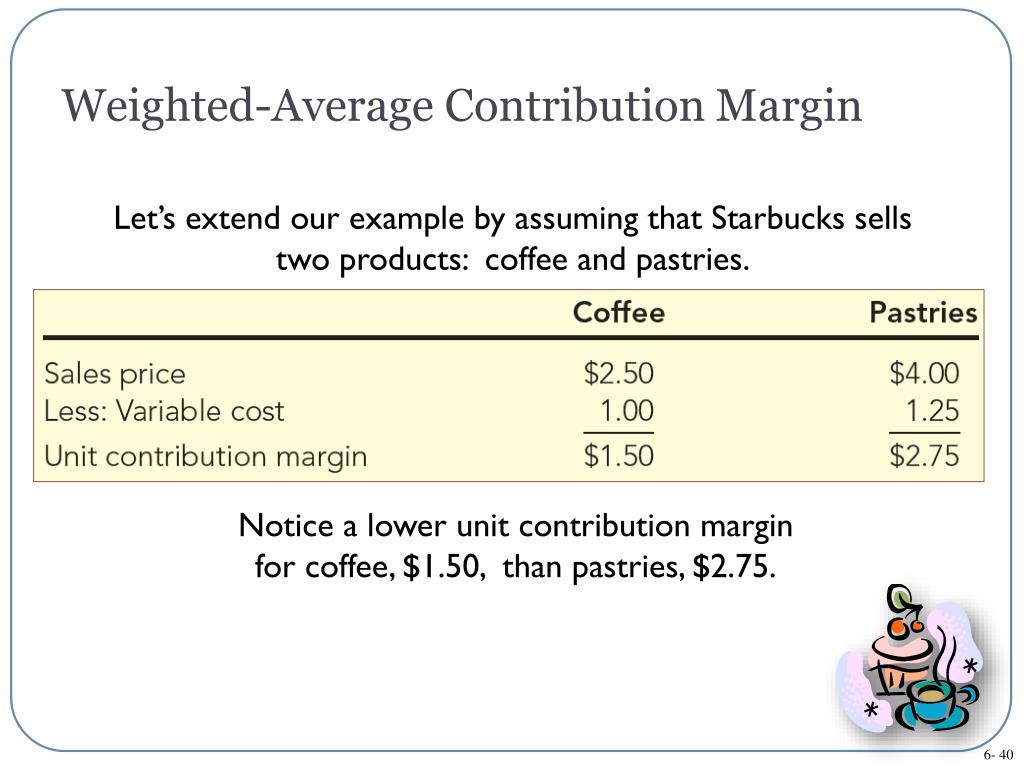

It requires considering fixed cost, variable cost, price per unit. Step 3: Finally, the simplified ratio will be displayed in the output field. Break-even analysis calculates the ideal unit price and quantity needed for making a. Step 2: Now click the button Solve to get the simplified form. For example, if P/V Ratio is 25%, then the marginal cost percentage would be 75% (100-25). How to Use the Ratio Calculator The procedure to use the ratio calculator is as follows: Step 1: Enter the x and y value in the respective input field. Use the CM ratio or percentage to determine how your contribution margins affect net income. (a) Determination of marginal costs for any volume of sales: Deducting P/V Ratio from 100 can arrive at Marginal cost percentage. Per Unit CM Ratio Per Unit CM / Per Unit Sales. It can be calculated using either the contribution margin in dollars or the contribution margin per unit. Where, Sales – Total Costs = Profits Uses of P/V Ratio: You may also want to try our Aspect Ratio Calculator. Therefore, a ratio of 8/6 is an equivalent ratio of 4/3: in that particular ratio calculation, you should just multiply 4, as well as 3, by 2. When total sales and total costs are given for two periods of activity, the following formula may be used to calculate the P/V Ratio: In order to keep numbers in direct relation you should first divide or multiply, which depends on your task, them in the ratio. This is often expressed as a percentage and calculated as follows: A more appropriate term might be the Contribution/Sales Ratio. The ratio that shows the relationship between ‘he value of sales and contribution is called as P/V Ratio. The number of units involved coincides with the expected volume of output. Considering the following data, lets calculate Contribution, PV Ratio, BEP & Margin of Safety. The variable cost per unit is 8, and the total fixed cost is 40,000. Estimated sales for the period are valued at Rs. Company A manufacture and sell 5,000 articles at a price of 20 per article. Variable cost per unit for the single product being made is Rs.6. The fixed costs for the year are Rs.40, 000. Hence, the results of the break-even analysis should be interpreted subject to the limitations of the above assumptions. A variable expense ratio is also known as the variable cost ratio. Enter quantity and item unit and this calculator shows the work on how to solve for the. The sales per unit can be called the selling price per unit. The result shows that Company A must produce and sell 500,000 units of its product to pay for their business’s fixed. Calculate unit rate, unit price or unit cost for a rate or ratio. Fixed costs 60,000 Variable cost per unit 0.80 Revenue or selling price per unit 2 50,000 units.

(e) Productivity per worker, and efficiency of plant, etc., remain mostly unchanged.Īny change in any one of the above factors will alter the break-even point and the profits will be affected by factors other than volume. Break even point Fixed costs / (Revenue per unit Variable cost per unit) In this example, suppose Company A’s.

0 kommentar(er)

0 kommentar(er)